does instacart take out taxes for employees

The first is the additional employer share of payroll taxes which are paid by independent contractors but not employees which works out to 765 of pay. If you owe more than 1000 in taxes for the year and do not pay taxes quarterly youll be hit with a late payment penalty by the IRS.

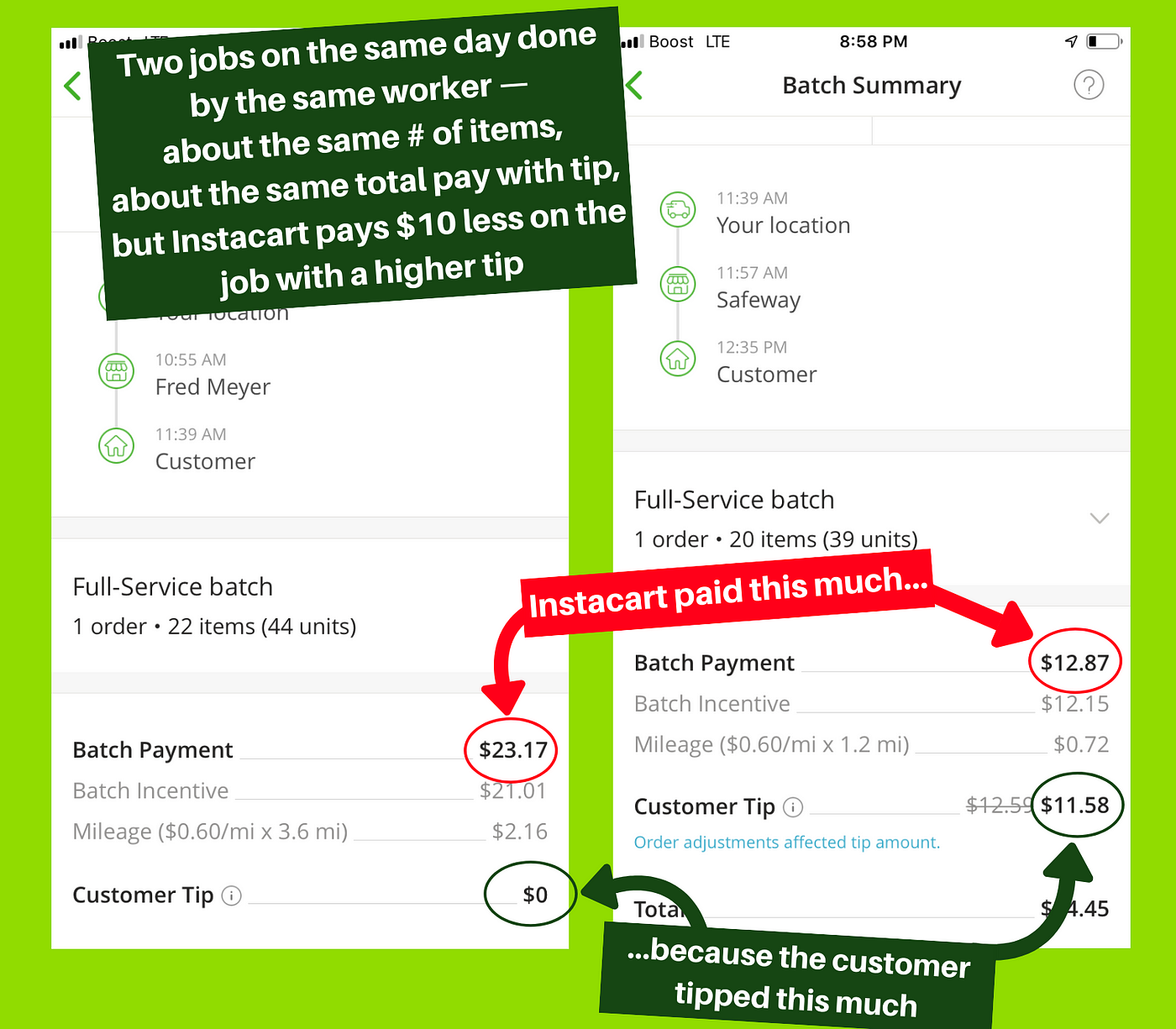

Instacart Here S Our 22 Cents No More Tip Theft Low Pay And Black Box Pay Algorithms By Working Washington Medium

Employees have taxes taken out.

. This can make for a nasty surprise when tax time rolls around as youre responsible for paying the necessary state and federal income taxes on the money you make delivering for Instacart. Please search your inbox for an email titled Confirm your tax information with Instacart Instacart does not have your most current email address on file. Instacart shoppers are required to file a tax return and pay taxes if they make over 400 in a year.

You dont send the form in with your taxes but you use it to figure out how much to report as income when you file your taxes. What Happens if I Dont File Instacart Taxes. Depending on your location the delivery or service fee that you pay to Instacart in exchange for its service may also be subject to tax.

The tax andor fees you pay on products purchased through the Instacart platform are calculated the same way as in a physical store. The total amount including all applicable taxes will become charged to your payment method on file when you receive your order. If you cannot find any good tips its about 7-8 a batch which takes upwards of an hour.

If you can find batches with good tips the pay is nice and very flexible hours. According to the IRS if you earned more than 400 this year as an independent contractor through Instacart alone you are required to pay self-employed taxes tips get taxed too. Except despite everything you have to put aside a portion of the cash you make every week to cover them.

For gig workers like Instacart shoppers they are required to file a tax return and pay taxes if they make over 400 in a year. This is a standard tax form for contract workers. This includes self-employment taxes and income taxes.

To make saving for taxes easier consider saving 25 to 30 of every payment and putting the money in a different account. Yes - in the US everyone who makes income pays taxes. Has to pay taxes.

The SE tax is already included in your tax due or reduced your refund. The taxes on your Instacart income wont be high since most drivers are making around 11 every hour. You could work a day making 25 an hour just to get 750 an hour the next day.

There are a few different taxes involved when you place an order. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare. You would face the same penalties as any other business that doesnt file taxes.

However in-store shoppers are Instacart employees taxes are taken out of their pay and they file W-2s in 2022. As an independent contractor you must pay taxes on your Instacart earnings. The 1413 is the amount youll have to pay in self employment tax.

The exception is if you accepted an employee position. They will owe both income and self-employment taxes. Up to 5 cash back Order same-day delivery or pickup from more than 300 retailers and grocers.

If you are an independent contractor for Instacart follow the link here to find out more information regarding the deductions that can be claimed. Does Instacart take out taxes. Does Instacart Take Out Taxes For All Employees.

Instacart does not take out taxes for independent contractors. You should note that you dont have to pay self employment tax if your taxable profit is less than 400. I worked for Instacart for 5 months in 2017.

If you make more than 600 per tax year theyll send you a 1099-MISC tax form. No minimums to stay working and I sometimes had to go on hiatus. Report Inappropriate Content.

Whatever you dont cash out will be directly deposited into your account and takes 1 to 3 business days for processing normal time frame. 153 of that 9235 is 1413. Because Instacart shoppers are contractors the company will not take taxes out of your paycheck.

The email may be in your spamjunk mail folder. You do get to take off the 50 ER portion of the SE tax as an adjustment on line 27 of the 1040. However in-store shoppers are Instacart employees taxes are taken out of their pay and they file W-2s in 2022.

There is a 45 late fee plus interest for each month your tax return is late but only a 05 late fee for each month your payment is late. Depending on your location the delivery or service fee that you pay to Instacart in exchange for its service may also be subject to tax. Tax Deductions You Can Claim As An Instacart Driver.

Get more tips on how to file your taxes. Stride Tip If you ever owe more taxes than you can afford and youre not able to pay your entire owed tax on time make sure to file your tax return anyway. Everybody who makes income in the US.

Instacart will file your 1099 tax form with the IRS and relevant state tax authorities. As youre liable for paying the essential state and government income taxes on the cash you make delivering for Instacart. You have the option to get paid instantly and can get your tips you make for the day after 24 hours however you do have to complete 5 batches first one batch can have multiple orders.

The taxes on your Instacart income wont be very high since most drivers are making around 11 per hour but you still need to set aside some of the money you make. Does Instacart take out taxes for its employees. What that ultimately means is your actual self employment tax is 1413 of your Schedule C profits.

As an independent contractor you must pay taxes on your Instacart earnings. Up to 5 cash back Order same-day delivery or pickup from more than 300 retailers and grocers. However the weekly pay data provided by Instacart does not include an.

Indeed if your earnings in Instacart is above 600 per tax year you will receive a 1099-MISC tax form. A second and much larger added expense is the cost of driving including gas repairs depreciation etc. Download the Instacart app or start shopping online now with Instacart to get groceries alcohol home essentials and more delivered to you in as fast as 1 hour or select curbside pickup from your favorite local stores.

Do You Have to Pay Taxes on Instacart. If they make over 600 Instacart is required to send their gross income to the IRS. Instacart usually wont take out taxes since youre an independent contractor and have to pay estimated taxes.

This form works for all. So you get social security credit for it when you retire. You must report these.

Please check any other email addresses you may have used to sign up for Instacart or reach out to Instacart to update your email. I got my 1099 and I have tracked all my mileage and gas purchases but what else do I need to do before I file.

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Does Instacart Take Out Taxes In 2022 Full Guide

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Taxes The Complete Guide For Shoppers Ridester Com

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Instacart Taxes The Complete Guide For Shoppers Ridester Com

What You Need To Know About Instacart Taxes Net Pay Advance

How Much Do Instacart Shoppers Make The Stuff You Need To Know

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

What You Need To Know About Instacart Taxes Net Pay Advance

Instacart Taxes The Complete Guide For Shoppers Ridester Com

When Does Instacart Pay Me A Contracted Employee S Guide

What You Need To Know About Instacart 1099 Taxes

Instacart Taxes The Complete Guide For Shoppers Ridester Com

When Does Instacart Pay Me The Complete Guide For Gig Workers

Does Instacart Take Out Taxes Ultimate Tax Filing Guide

Filing Your Taxes As An Instacart Shopper Tax Tips For Independent Contractors Youtube

Reporting Income On Taxes 2021 Doordash Uber Eats Grubhub Instacart

Instacart Taxes The Complete Guide For Shoppers Ridester Com